Most people think of traditional investment options like cash, bonds, and stocks when they hear the word investing. While many are familiar with conventional investing opportunities, there’s another category of investing called alternative investments.

Just like investment management strategies, alternative investments cover a vast range of investments with unique characteristics. While alternative investments can vary in terms of structure and accessibility, they share some key features:

- Alternative investments are unregulated by the US Securities and Exchange Commission (SEC).

- Alternative investments are illiquid. In other words, they can’t be sold easily or converted to cash.

- Alternative investments won’t move in the same direction as other assets when conditions in the market change.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

Alternative Investments You Can Look Into

If you are considering alternative investments, below are some of the options available at your disposal:

Private Equity

Private equity is a broad category referring to capital investment not listed on a public exchange like the New York Stock Exchange or made into private companies. Private equity has several subsets, including:

- Venture capital. This focuses on early-stage ventures and startups.

- Growth capital. Helps mature companies restructure or expand.

- Buyouts. A company or one of its divisions is bought outright.

One crucial aspect of private equity is the relationship between the company receiving the capital and the investing firm. Typically, private equity companies provide more than just capital when they invest in a firm. They also offer other benefits such as talent sourcing assistance, mentorship to founders, and industry expertise.

Commodities

Commodities are real assets and mostly natural resources like oil, natural gas, agricultural products, and industrial and precious metals. Commodities are seen as a hedge against inflation.

Commodities are also not sensitive to public equity markets. In addition, the value of commodities tends to rise and fall with supply and demand. Higher demand for commodities can result in higher prices and, of course, investor profit.

Commodities are not new to the investing scene. Commodities have been traded for many years now. The earliest formal commodities exchange was done in the 16th and 17th centuries in Osaka, Japan, and Amsterdam, Netherlands.

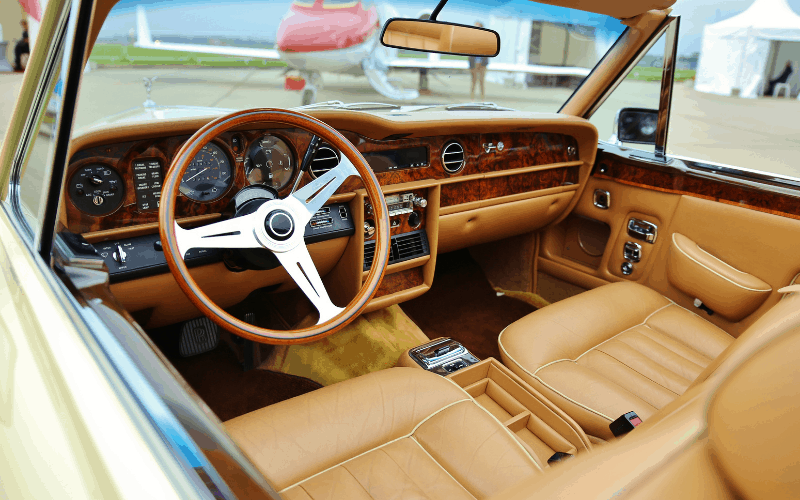

Collectibles

Collectibles cover a vast range of items—from rare wines to baseball cards and vintage cars. Investing in collectibles involves purchasing and maintaining physical items, hoping the value of the assets will eventually appreciate over time.

While collectibles can seem like an exciting and fun option compared to other types, collectibles can be risky because of lack of dividends, high cost of acquisition, and the potential destruction of the assets if not cared for properly or stored accordingly.

The primary skill required when investing in collectibles is experience. You need to be a true expert if you want any returns on your investment in collectibles.

Real Estate

There are different types of real assets. For instance, there’s land, farmland, and timberland. However, the world’s most significant asset class is real estate. Aside from its size, what makes real estate an interesting category is it has characteristics that are similar to bonds.

Just like real assets, valuation is considered a challenge in real estate investing. Some of the common real estate valuation methods include discounted cash flow, sales comparable, and income capitalization.

To succeed as a real estate investor, it is essential that you have strong valuation skills and you have a clear understanding of when and how to use diverse methods.

Final Thoughts

Alternative investments provide greater portfolio diversification. It also has a lower overall risk and a higher potential for higher returns. If you are considering investing in alternative investments, it would be best to find out all there is to know about them, so you will know if they are the right investment option for you.

Don’t forget to Like, Share, Tweet, and Pin this post.