Debt can be crippling.

Especially when you have no money and no hope for getting out of debt.

Add in collection notices, calls from bill collectors, and a plummeting credit score… the situation can be depressing and unbearable.

Despite how emotionally draining being in debt can be, you can get out of debt. Even when your money is tight.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

How to Get Out of Debt

Start a $1000 Emergency Fund

The very first step to getting out of debt is to save $1000 for your emergency fund. This step is critical.

It sounds strange that you would start with saving money and not paying off your debts. But it is important that you set yourself up to be successful at reaching your debt repayment goals.

For most people, emergencies are the cause of their debt in the first place. If your stove breaks and you don’t have the cash to fix or buy a new one, your first thought is to put it on your credit card.

This creates debt!

Having an emergency fund protects you from life’s

Related Post: How to Save Money When You’re Broke

Don’t Create Additional Debt

It is impossible to get out of debt if you are adding additional debt. This means no more credit card spending.

Any purchases that would add to your current debt should be avoided. If you can’t pay cash, then you don’t need it.

Document Your Debt

In order to clear your

Make a list of all of your debts. Include the amount you owe, minimum payments, and interest rates.

This list will be vital when you are coming up with how you plan to pay off your debt.

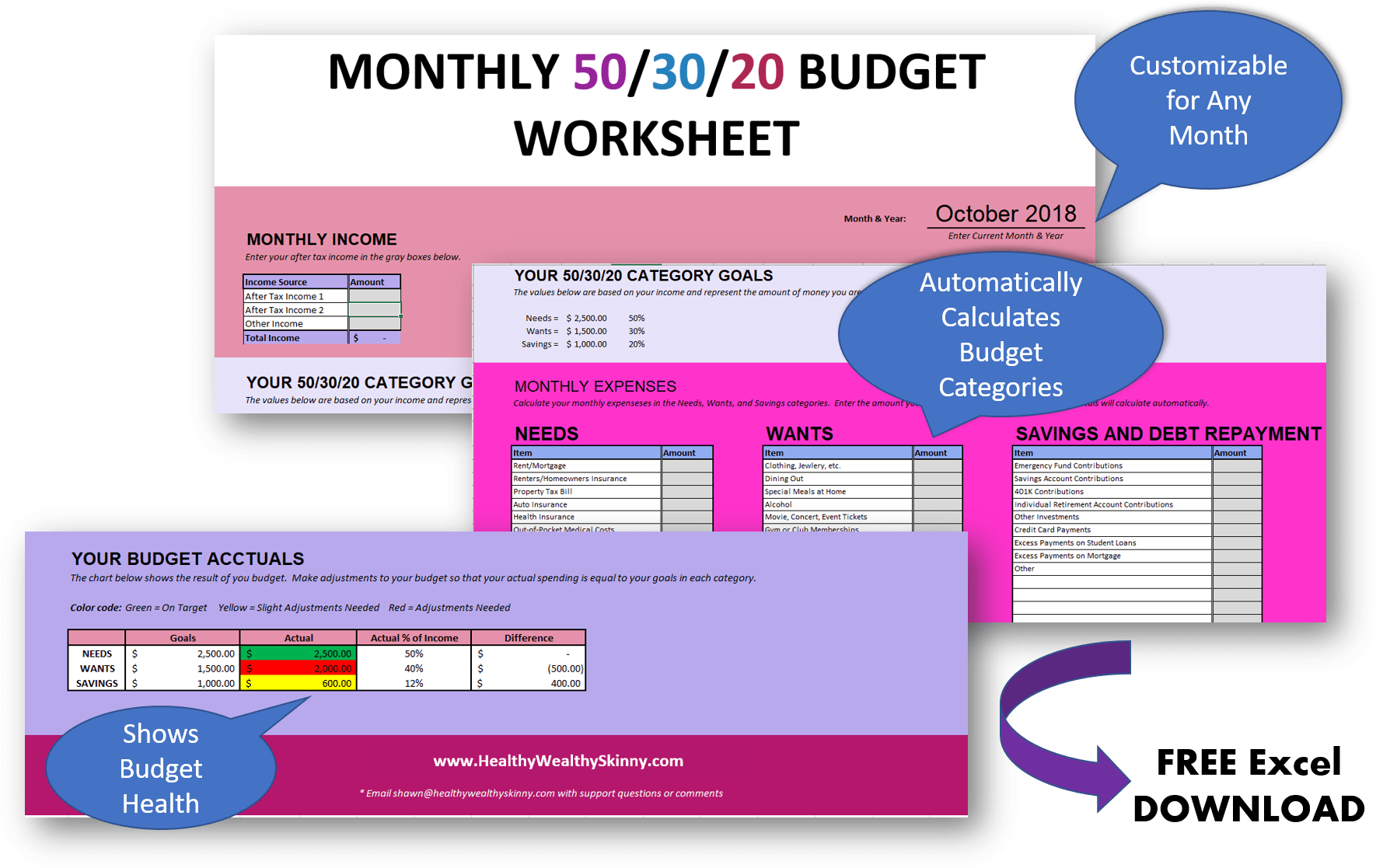

Create a Budget

Having a budget is an essential key to getting out of debt. A budget will show you exactly how much money you have and how you are spending it.

A 50/30/20 Budget is a flexible type of budget that will allow you to allocate the proper amount of money to your debt removal process.

Once you’ve created your budget, you should monitor it closely to ensure you stay on track. This can be done by using budget trackers or apps.

You will also be aware of any extra money that you might have available to spend on your debt.

Download a copy of our free Monthly 50/30/20 Budget Worksheet. It’s a free excel spreadsheet to help you create and maintain your budget.

Create a Debt Repayment Plan

This is where you put together the actual plan of how to pay off your debts. There are multiple ways this can be approached.

There are two popular methods that you can use to create a debt repayment plan. These methods are the Debt Avalance Method and the Debt Snowball method.

In the Debt Avalanche method, you organize your debts from those with the highest interest rate to those with the lowest interest rate. You focus the majority of your effort on the debt with the highest interest rate first while making the minimum payment on all other debts.

As you pay off one high-interest debt, you move to the next debt on the list. The benefit of this method is that you will save money on interest over time.

In the Debt Snowball method, you organize your debts from those with the lowest balance to those with the highest balance. You do not consider the interest rates when creating your debt payoff list.

You focus the majority of your debt payoff effort on the debt with the lowest balance first while making the minimum payment on all other debts. After you pay off the smallest debt, you move to the next debt on the list.

The benefit of the Debt Snowball method is that you pay off small debts quickly and get a sense of motivation and accomplishment as you can remove debts off of your list faster.

You can grab a free Debt Snowball Spreadsheet in excel or google sheets format here.

Important Note: When paying off credit cards, do not close or cancel your accounts. Leave the account open with a $0 balance. Closing credit accounts can harm your credit score.

Allocate Extra Money to Your Debt

Paying off your debt might seem like it will take forever. Especially if you are trying to figure out how to pay off debt with low income.

This is where making extra money comes in handy.

The great news is you do not have to depend solely on the income from your job. There are multiple ways to make more money despite your current income.

You should also allocate any unexpected extra money to your debt. Unexpected bonuses, gifts, tax refunds, or winnings should be used to pay off debts on your debt repayment plan.

You Can Get Out of Debt

With a little patience and planning, you can get out of debt.

Paying off debts takes time but it is well worth the effort for your financial health and peace of mind.

Change how you approach your spending and you can eliminate old debt and ensure that you don’t create any new debt.

Leave a comment and share your debt repayment techniques.

Don’t forget to Like, Share, Tweet, and Pin this post.

Debt is a real problem that most people cant escape. Getting a side job helps too. One income is never enough

Having an extra income source is a big help. However, everything starts with the right mindset and a well thought out plan.