Creating a budget is the first step in successfully managing your finances. Your budget will serve as your roadmap and will help you make all of your financial decisions. When deciding to create your budget you will quickly learn that there are many different budgeting methods to choose from.

Your next step is to understand the different budgeting methods so that you can choose the right one for you. You will be more successful with your budget if you choose a budgeting method that complements your personality and financial situation.

Let’s Review some of the most common budgeting methodologies…

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

Types of Personal Budgets

There are many different approaches to budgeting. Some are strict and others are very flexible.

When choosing a budgeting method it is best to know where you stand financially. You can do this by documenting all of your after tax income and all of your expenses.

Doing this will give you an idea of how much you really know about your money. It will also help you with determining budget categories which are needed for almost any budgeting method you decide to use.

It is also a good idea to track your spending for about a month. This will help you determine exactly where your money is going.

You can do this by writing down everything you spend money on. It does not matter if you spend cash, use a credit card, or a debit card… write it down.

It doesn’t matter if it’s one dollar or 100 dollars. You should track all of your spendings and categorize it because you will need this information later when creating your budget.

Cash Envelope

In the cash envelope budgeting method your income is converted into cash and placed into envelops allocated to your expenses. When starting this budgeting method you will need to determine how much money you require in each of your budget categories.

You would then place the pre-determined amounts of cash into separate envelopes labeled with the appropriate budget category. As you begin paying your expenses throughout the month, you will pull cash from the appropriate envelope.

This budgeting system is best for people who are comfortable working with cash. It is considered a strict budgeting method. When money from an envelope is gone there is no more money to spend.

The cash envelope budgeting method is great if you have trouble sticking to your budget or overspending with debit cards. Studies have also shown that some people spend less money when dealing with cash.

Zero-Based

The Zero based budgeting method is also known as the Dave Ramsey Budget. It is a simple budgeting method where your income minus your expenses must equal zero.

This budgeting technique is best for people who have a set income each month or at least can reasonably estimate their monthly income. It is considered a strict budgeting method because all of your money must be accounted for.

Experienced budgeters are more successful with this method

You can get a copy of our free Zero based budgeting spreadsheet here.

50/30/20 Rule

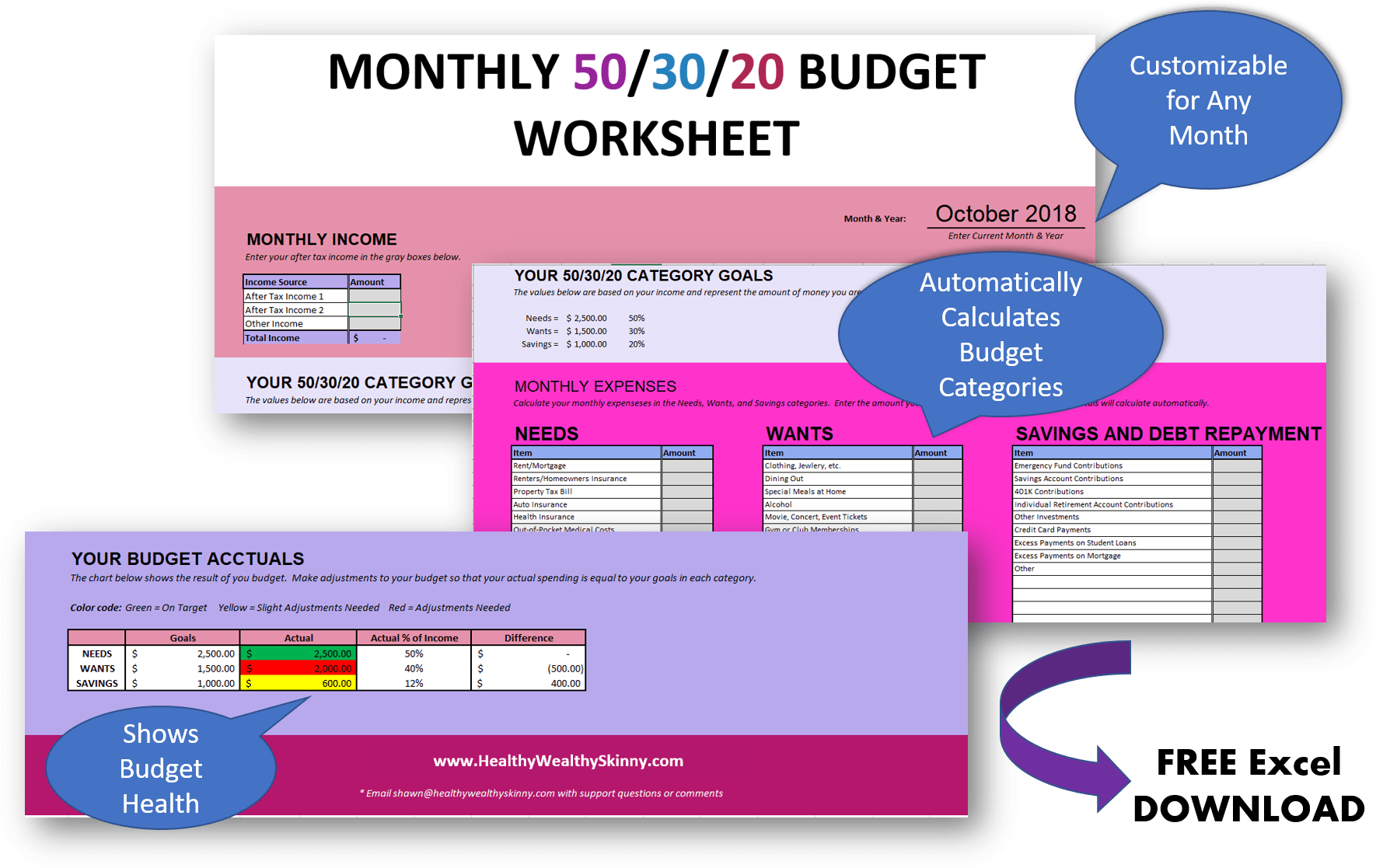

The 50/30/20 Rule budgeting method also known as a proportional budgeting system or a percentage based budget. It is a budgeting method where you break your budget up into categories and assign a percentage to each category.

In the 5/30/20 budget your after tax income is broken down into 3 categories: 50% Needs, 30% Wants, 20% Savings/Debt

This type of budget is best for newbie budgeters as it doesn’t require meticulous tracking of all of your expenses. It is considered a flexible budgeting method because your expenses in each category can change from month to month. You only have to maintain your predetermined percentage categories. You can also customize the percentages for each category to meet your needs.

The 50/30/20 Rule budget is not particularly good if you have a lot of debt or big savings goals.

Download a copy of our free Monthly 50/30/20 Budget Worksheet. It’s a free excel spreadsheet to help you create and maintain your budget.

Pay-yourself-first

The Pay-Yourself First budget is a simple budgeting method where you set aside a specific amount for savings and debt then spend remaining money any way you want.

With this type of budget to determine what percentage of your after-tax income you will “pay-yourself” each month. This amount is usually dedicated to going towards a savings goal or debt repayment plan.

You can then spend the rest of your money in any fashion you wish without tracking those expenses.

This budgeting technique is best for people who struggle with saving each month or those who don’t want to focus too much on budgeting each expense. It is a simple budgeting method focused only on reaching savings goals or debt repayment goals.

Budgeting System Software

After you choose the budgeting method that is right for you, you will need to determine how you will maintain your budget. Budgeting apps is your go-to if you would like to manage your budget electronically and on the go using your smartphone.

Two very popular budgeting apps are Mint and YNAB. They are both available on iPhone and Android devices. When choosing a budgeting app you will need to determine what budgeting method is used. For example, YNAB uses the zero-based budgeting methodology as every dollar has to be given a job.

How to Choose the Budgeting Method that’s Right For You?

There are a wide variety of popular budgeting techniques that you can choose form. The trick is choosing a method that works with both your personality and your current financial situation.

When trying to choose your budgeting method think of things like how much effort you are willing to put into managing your budget, what are you main financial goals, and how you will maintain your budget.

Sticking to Your Budget

Choosing a budgeting method and creating your budget is just the first step. You will need to make your budget personal to you, monitor your budget each month, and stick to it.

This is why choosing the right budgeting method for you is so important. If your budget is too strict or if you choose a method of managing your budget that is too cumbersome for you, you won’t stick to it.

These budgeting tips to help you be successful. Be sure to check them out.

Don’t forget to Like, Share, Tweet, and Pin this post.