Deciding that you want to be debt-free and actually taking the steps to make it happen is a courageous and monumental task. It takes planning, patience, and dedication.

There are some common mistakes that most people, myself included, make while they are on their debt-free journey. Avoiding these makes will put you ahead of the game as you start down your debt-free path.

If you’ve already made some of these mistakes… no worries. It doesn’t matter how many mistakes you make as long as you keep trying and never give up.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

My Debt Free Journey

I am 47 years old and I am not one of these personal finance guru’s who graduated from college and had everything figured out when it comes to finances. I’m also not one of these people who have paid off $150,000 in debt in 1 year while feeding a family of 12.

I am a normal everyday person who has been in debt, got out of most debt. Ignored some debt, accumulated new debt, got a divorce… got out of debt again. I continued to ignore some debt… and finally started to employ some real strategies when it came to my money that got me off of the emotional debt rollercoaster ride I was on for the most of my life.

There is not one mistake on this list that I have not made at some point in my life. I wanted to share that fact with you because sometimes you feel like everyone else has it all together and you are the only one messing up.

That is not the case. Everyone makes mistakes, and it is ok to recover from those mistakes and get back on the road financial freedom.

Debt Free Journey YouTube Series

My Debt Free Journey YouTube Series will help you through the ins and outs of becoming debt-free. The videos in this series include:

- How to Pay Off Debt (Debt Snowball vs Debt Avalanche)

- Emergency Fund vs Paying Off Debt

- Debt Free Journey Mistakes

- Side Hustles to Pay off Debt

- Change the Way You Think About Money – Change Your Money Mindset & Change Your Life

- Positive Money Affirmations | How to Change Your Mindset About Money | Repeat These Daily

Common Debt Free Journey Mistakes

Mistake #1 – Not Changing your Mindset

As I’ve gotten older I’ve learned that your mindset is an important part of anything you do. The way you think about things shapes your actions and emotions. Not changing the way you think about money is a mistake that many people make when trying to become free of debt.

Often, we don’t stop to figure out why or how we got into debt in the first place.

Am I an emotional spender?

Did something bad happen that caused me to go into debt?

Did I just completely ignore my financial situation?

Was I trying to live a life that was outside of my means?

Not determining why you are in debt and fixing those issues will only lead to your repeating the cycle. Once you know the mental pitfalls that might be causing your debt, you can make the appropriate changes and alter your money habits.

Related Post: Money Affirmations – Positive Affirmations To Attract Wealth

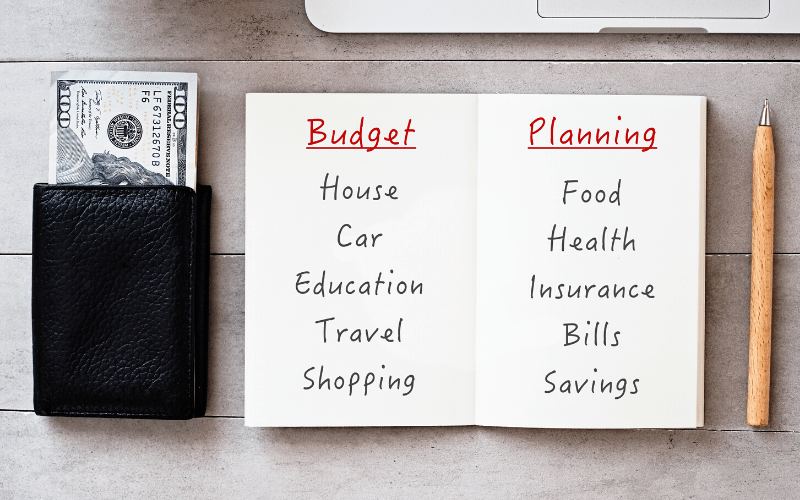

Mistake #2 – Not Having a Budget

A budget is the core foundational tool that you will need to know how you can attack your debt. Without it, you will not have a clear picture of how much income you have vs what you are spending each month.

Your budget will help you determine areas where you might be able to cut expenses. This could result in you having more money to allocate towards your debt repayment plan. Without a budget, you are basically flying blind.

There are various budget methodologies available to suit different personality types and financial situations. For example, the Pay Yourself First budget method is designed specifically for those who only need to focus on a savings goal or paying off debt.

Mistake #3 – Not Having an Emergency Fund

Not having an emergency fund is a big mistake when working on eliminating your debt. Without the safety net that an emergency fund provides, one bad thing could happen which could erase all the work that you have put into paying off your debt.

A very common question is… should I pay off my debt first or save for an emergency fund?

I cover this topic in detail in video #2 of my debt-free journey series. The answer might surprise you.

Mistake #4 – Continuing to Accumulate Debt

This one might sound like a no brainer but many people make the mistake of still using credit cards or borrowing money while they are on their debt-free journey. Accumulating more debt while you are trying to get out of debt is just counterproductive.

When you are getting out of debt it is imperative that you do not create any new debt. This includes using credit cards or taking out personal loans. Your goal is to subtract from your debt and not add to it in any way.

Mistake #5 – Not Having a Debt Pay off Plan

Not entering into your debt-free journey without a plan is indeed a mistake. This includes not documenting your full debt and not choosing a strategy to pay off debt.

The plan you choose is totally up to you. You may like the Debt Avalance Method over the Debt Snowball method. Or you may have an alternate or personal strategy that you like better.

The important thing is that you have a plan and that you stick to it. It’s also a good idea to track your progress. This will keep you motivated and let you know if you are on the right track.

Mistake #6 – Not Addressing Income Issues

At some point in our financial journey, we have to face the basic math. If you are not bringing in enough income, it is very hard to do things like pay bills, feed your family, save money, and stay out of debt.

Something had to give and in many cases, it’s paying off your debt.

Not addressing income issues is another common mistake. This might mean taking a look at your current job and deciding if you need to take action to get a promotion or strive for a better job.

Or you may love your current job and getting a side hustle might be a better answer.

Don’t forget to Like, Share, Tweet, and Pin this post.

Changing your mindset is one I’ve been working on lately. It really does help to have a more positive thought pattern regarding income and expenses.

So true Carri! It’s something that I focus on all the time. I’m a pretty positive person by nature but I still find my self saying negative things and I correct myself immediately.

Great info, Thanks! This isn’t an easy thing to do or to look at in a persons life, you have broken it down in a very doable way

Thanks Nancy! Accepting mistakes isn’t easy but it is the fastest way to regroup and move forward.

perfect timing with this post because my 2020 goal is to work on my financial freedom and investments! Looking forward to digging through all this.

Super happy the timing worked out. You might like my YouTube channel as well.

True on so many levels. I’m a personal finance blogger and the first thing I always suggest when people want to pay off debt is to get in the right mindset. It all starts there, as with everything else. Pinning for others to see 🙂

Thanks so much Corinne! It always amazes me how much mindset plays into everything we do in life. Self-sabotage is a real thing and I’m sure many people are fighting a losing battle against themselves.

Oh wow, these are some relatable mistakes! As I’m working on my debt free life, I will keep them in mind. Great to save money for emergencies.

I think there is comfort in knowing that sometimes when we make mistakes we are not the only ones. With that knowledge, it is easier to shake it off and start again.

Yes I can see where not having a few basics in place could cause a huge issue. I also think credit cards are a huge issue since they promote purchase that you do not have the funds for at the time, they should really only be used in emergency situtations.

If used responsibly there are some situations where credit cards can actually save you money. Especially when it comes to cash back rewards for things like travel. But it takes loads of discipline not to get caught up in spending money that you don’t have like you mentioned.

This article covers everything. Having a positive mindset regarding budgeting is not always easy but will definitely help to get you through tough times. Love the videos! You are such a natural in front of the camera!