When researching personal finance and how to manage your money the first step is always to create a budget. In many cases, you are not shown exactly how to it.

That is not the case today…

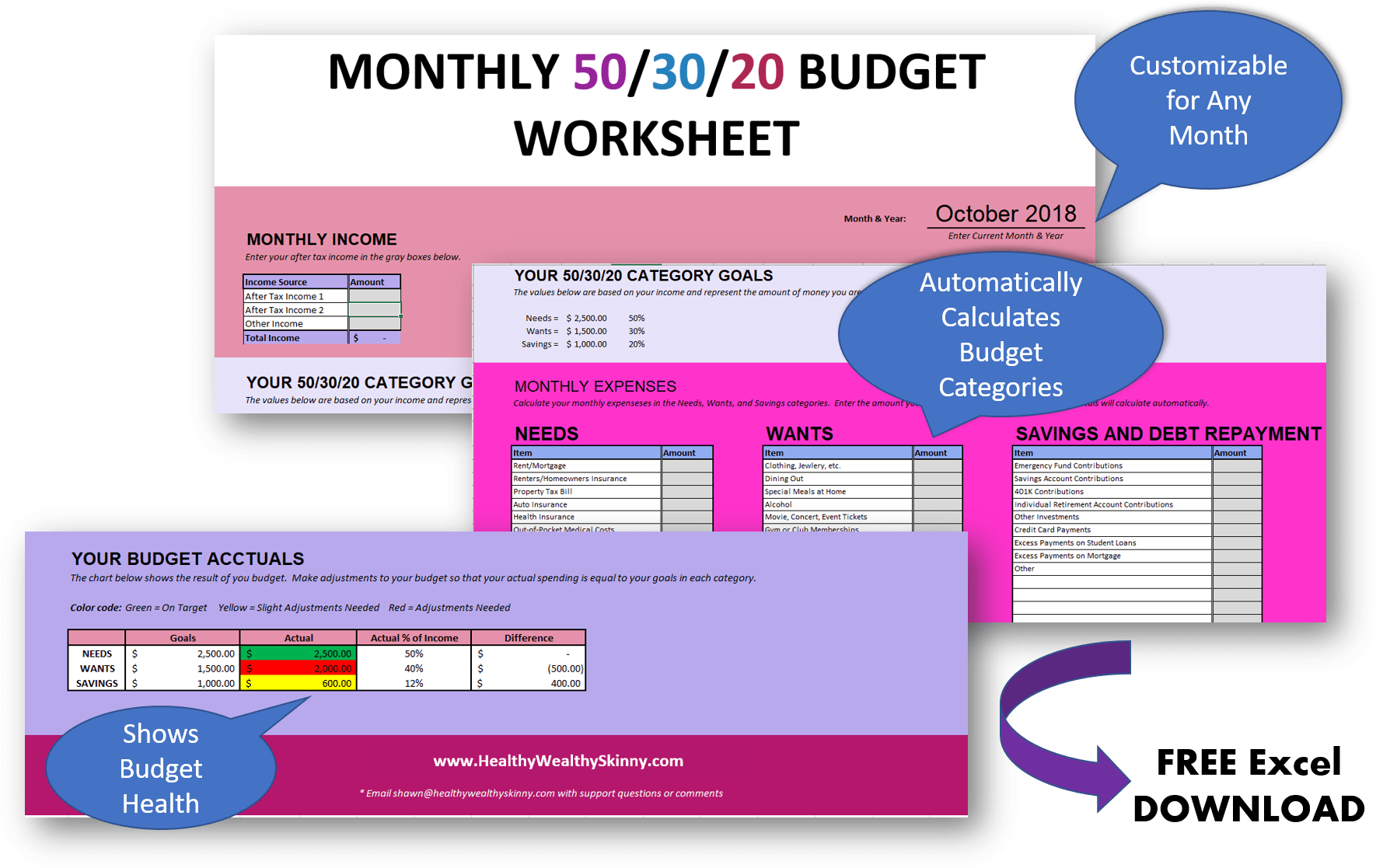

In this post, you will get step by step instructions detailing how to create a budget. You can also download our 50 30 20 Budget Printable worksheet that will help create your budget using the steps in this 2020 guide.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

Is the 50/30/20 Budget for You?

There are many different budgeting methods out there and they all have their pros and cons. When choosing a budget you need to choose one that fits your personality, experience level, and finances.

Watch this video for a quick overview of the common budgeting methods. It will help you determine if the 50/30/20 Rule Budget Methods is for you.

50/30/20 Rule Budget Method Explained

The 50/30/20 rule for spending and saving was created by Elizabeth Warren. She co-authored a personal finance book with her daughter, Amelia Warren Tyagi.

Her book was titled: All Your Worth: The Ultimate Lifetime Money Plan.

The 50/30/20 budget method is a simple method of creating a budget that focuses on three main categories.

Needs, Wants, and Savings

Your after-tax income is divided into these three categories based on certain percentages.

NEEDS = 50%

WANTS = 30%

SAVINGS = 20%

At this point, it is clear to see how the 50/30/20 Budget Method got its name.

The 50/30/20 budget method is best suited for those who want a simple and flexible way of maintaining their budget. The amounts you spend on items in each category can change from month to month.

You only need to ensure that you remain within the 50%, 30%, and 20% spending limits of each category. This will ensure that you are always moving toward

How to Create a 50/30/20 Budget

Now that you have a clear understanding of how the 50/30/20 budget works, let’s dive into how to create one.

Step 1: Decide How You Will Track Your Budget

Budget Spreadsheet

Budget spreadsheets are great for those who are comfortable working on a desktop computer, laptop, or tablet. They allow you to track your budget items electronically.

Most budget spreadsheets will also complete calculations for you. This allows them to serve as a 50 30 20 budget calculator in excel.

Free 50/30/20 Budget Spreadsheet

Download your copy of our 50/30/20 Excel Budget Spreadsheet and complete it as you follow along with the rest of the guide.

There is a video that will show you step-by-step how to use the free budget spreadsheet at the end of this post.

Budget Printables

Budget printables are designed for those who like to put pen to paper. They allow you to write down your budget and track things manually.

Budget printable are not fancy but they are great if you like to keep binders or printed copies of your important paperwork.

Download your copy of our 50/30/20 Budget Worksheet Printable and complete it as you follow along with the rest of the guide

Budget Apps

Budget apps are another method you can use to track your 50/30/20 budget. They are great if you are the busy on the go type. You can track your budget right from your smartphone no matter where you are.

Here are a few free budget apps that support the 50/30/20 budget method.

Bullet Journal

For the creative types out there the Bullet Journal is the perfect option. Using a bullet journal will give you the freedom to design your very own budget tracking spreads.

Related Post: 5 Ways to Use Bullet Journal Spreads to Organize Your Life

Step 2: Calculate Your Monthly Income

In this step, you are going to calculate how much money you have to spend each month. To calculate this value you are going to use your after-tax income.

Write down the after-tax value of your income from all sources. This will include income from your job(s), your spouse’s income, and income from side hustles.

Related Post: 11 Ways to Make More Money Regardless of Your Current Income

Once you know your total income. Calculate 50% of your total income and write that value down as your Needs Total.

Needs Formula:

Needs = 0.5 * after-tax income

Next, calculate 30% of your total income and write that value down as your Wants Total.

Wants Formula:

Wants = 0.3 * after-tax income

Finally, calculate 20% of your total income and write that value down as your Savings Total.

Savings Formula:

Savings = 0.2 * after-tax income

You now know the amount of money you have to spend in each one of your 50/30/20 Budget Categories.

Step 3: Calculate Monthly Expenses in Each Category

It’s now time to see where you are spending your money.

In this step, you will write down all of your monthly expenses in each 50/30/20 budget category. If you are using our 50/30/20 budget spreadsheet or 50/30/20 budget worksheet printable, common expense items are listed for you.

Needs

The expenses in your Needs category are those expenses that are required for you to live. This includes your rent/mortgage, utilities, and insurance. only enter expenses in this category if they are required living expenses.

You might be tempted but your hair and nail spending can’t be added here. 🙁

Write down the fixed monthly amount you spend on each of your needs and sum them up to get a total.

This value should be less than or equal to the “Needs Total” you calculated in Step 2. Don’t worry if it is not when you first create your budget. There is a step for adjustments later.

Wants

The expenses in your Wants category are those that are nice to haves. This includes your Netflix subscription, clothes, or dining out with friends.

Using your preferred budget tracking method, write down or enter your expenses that belong in the Savings category. This value should be less than or equal to the “Wants Total” you calculated in Step 2.

Again, don’t worry if it is not when you first create your budget. There is a step for adjustments later.

It is best to allocate items to your Needs and Savings categories first. This will allow you to adjust your “Wants” to meet your financial goals.

Not to be a buzz kill but you must remember you can’t have everything you want. Keep in mind that things like vacations go into this category as well.

You may want to sacrifice a few restaurant visits in order to save for that girl’s trip to Cancun or the annual guys fishing trip.

Savings

Saving money is an important aspect of your financial health. Your 50/30/20 Budget is designed to ensure that you have ample savings and eliminate debt.

The expenses in your Savings category are those related to saving money for your future and repaying debts. As we calculated above, 20% of your after-tax income will be dedicated to savings.

Using your preferred budget tracking method, write down or enter your expenses that belong in the Savings category. This value should be less than or equal to the “Savings Total” you calculated in Step 2.

And by now you know the drill… you can adjust this later.

Step 4: Set Financial Goals

The very fact that you are reading this post means that you probably have some financial goals that you want to meet. You might be saving for a

In this step, it’s time to start setting your financial goals. When just getting started there are a few standard financial goals that you should start with. These include having an emergency fund, paying off debt, and saving for your retirement.

Emergency Fund

An emergency fund is money that you set aside for unexpected expenses. Creating an emergency fund should be one of your first financial goals. It will ensure that you are able to survive financially when the unexpected happens.

It is recommended that you start with an initial emergency fund goal of $1000. Once you reach $1000 in your emergency fund you can then work towards reaching a balance of 3 to 6 months of your monthly salary.

This amount will ensure that you have an ample amount of money to survive emergencies such as a job loss or injury that will hinder you from working.

Pay-off Debt

Paying off high-interest debt such as credit card bills should be one of your top financial goals. The interest you are paying on high-interest debt is money that you could be spending elsewhere.

Write down your current debts and determine which ones you should start paying off first. Pay close attention to interest rates as they will help you determine which debt to attack first.

Retirement Savings

Once you’ve got your emergency fund set up and you are effectively paying off your debt you can focus on your retirement.

One of the easiest ways to save for your retirement is to set up an Individual Retirement Account or IRA. An IRA is a type of investment account with tax benefits that can help you save for retirement.

Step 7: Monitor Your Budget

At this point, your 50/30/20 Budget should be all set up. It’s now time to start monitoring your budget using the tracking method that you chose in Step 1.

Monitor your budget on a weekly basis to ensure that you are within the spending limits of your Needs, Wants, and Savings categories.

Try using our Daily Expense Tracker in conjunction with our Monthly 50/30/20 Budget Worksheet for detailed tracking of your spending and your budget.

You can also add in our Christmas Budget Tracker to make sure you stick to your financial goals during the holidays. It is designed especially for those using the 50/30/20 Budget method.

Step 8: Make Adjustments

Your budget is a work in progress. You will not get it right on your first try. As I mentioned earlier there is a step for making adjustments.

The longer you monitor your budget the better you will get at identifying adjustments that need to be made and making good financial decisions. It may take you a few tries to get each of your budget categories in a working state.

Also, keep in mind that the 50/30/20 budget method allows you some flexibility in each category. The individual items in each category can change from month to month. Your goal is to ensure that you stay within the 50/30/20 boundaries.

Stick to it and don’t make the mistake of giving up too soon.

How to Use the Free 50/30/20 Budget Spreadsheet

Leave a comment and share your experiences with the 50/30/20 Budget method.

Pin this to your Budgeting or Finance Boards

Don’t forget to Like, Share, Tweet, and Pin this post.

Definitely a great post! This will help me re-evaluate my financial situation right now.

Thanks Ruby. I really like the flexibility of the 50/30/20 budget method. Give it a try.

Shawn,

I ordered your budget worksheets last night, and I have not received them yet.

I understand that it was a download. After I ordered it, I never received the option to download the worksheets.

Please send the sheets or refund my money.

Hi Scott,

I can see your order. I have resent your download email. If you don’t see it, check your junk/spam folder. If you still don’t see it, let me know and I’ll email you the worksheet directly.

I found the issue. There was an error in your email address. I have corrected it and you should now see it. I’ll also email you directly just in case you aren’t on the website to see this comment.

Just started looking into my finances and love this post!! Thank you so so much!

You’re welcome Sofi!

This is a fabulous post! So detailed and a useful tool for your readers. For me, we try to reduce the wants column and up the savings column. But then we’ve got big dreams!

Thanks Charlotte! Saving more is a good strategy. Especially if you have big dreams. ?

Ha! If only. We have a housing gap in Salt Lake City that is driving rents sky-high. My rent alone is more than half my take home pay. There’s no room for wants and saving 20%? In my dreams.

I’ve definitely been there before Annie. That’s where getting a side hustle definitely helps. But I must say starting a side business or job is easier said than done. Speaking from experience I spend a lot of time working. But for me, it’s what I love doing and I have a good family backing so it works.

nice post. I wonder where giving/charity is in all of this.

Thanks Megan. For me, I place Giving/Charity under my wants category. Giving is something that I enjoy and want to do. It isn’t a required living expense. But remember that this is your budget. Do what feels right to you. 🙂

What if your monthly income fluctuates based on busier times of the year for your side hustles? Is it best to go based off a rough average of what you bring in, in a month? Or can you go by each paycheck with the 50/30/20 and if you know what’s due the 1st half of the month split it amongst just those then split the rest amongst the other paycheck?

Great question Sami! My suggestion would be to go with a rough average. You’ll have to account for the error in your estimations but as you get more familiar with your income fluctuations you’ll get better at your estimates.

When I did mine, I budgeted on the lower end (the lowest amount I would get paid), and for bills that change like my power/gas bill I budget on the higher end (the most I might pay), and then on months when there was extra left, it automatically went to savings!

Great, thank you so much! 🙂 I can’t wait to try this!

I have been trying to budget and save for some time now and could not get any budget off the ground. I found this and followed the savings plan and although my needs are greater than 50% its fantastic. For the first time in years I have savings. Nice and simple, easy to follow. Its great. I have a plan to keep within the 50/30/20 and I will get there. I tell you what, once you have some savings the pressure reduces significantly. Thankyou very much. Its awsome.

Hi Simone! I’m so happy to hear the 50/30/20 Budget is working for you. I’ve tried a few budgeting methods myself and this one is my favorite.

I will indulge with this website!

#sleepymomstatus

Welcome to the HWS family!

Anything for income and expanses need budget and i like this method 50/30/20-Budget.

What if you have money left in a category, like needs… let it roll over? Move it to another category? Thank you. Kim

Hi Kim,

In my opinion, this is truly a judgment call. You could use the extra to pay down debt if needed or it could go towards savings. Having extra money left over in your Needs category is not a bad place to be.

Hello, why credit card payment is in the savings? Credit card is a payment tool and the expenses can be in needs or wants.

Great question! The Savings category is made up of both savings goals and debt repayment goals. Credit card payments for me falls in both my Needs and Savings category. I place my monthly minimum payments in the Needs category. I need to pay at least the minimum so that I don’t hurt my credit score. I also like to practice, not carrying a balance on my credit card each month if I don’t have to. The additional portion that I pay on each card is apart of my Savings/Debt category.

Keep in mind that Needs, Wants, and Savings will differ from person to person. For example, if you barely have enough money to take care of your basic living necessities then paying the minimum balance on your credit card may not be a Need because having food to eat and a roof over your head is more important based on your financial circumstances.

I hope this helped. Let me know if this wasn’t clear.

Shawn 🙂

Hello,

It is not clear for me. For example, I often use my credit card in order to pay for grocery, shopping, fuel for car, etc. Then, these expenses go to related category in needs or wants. Those expenses can be seen in the Credit card statement at the end of the month.

It will be double registration of the expenses if we write the credit card debt in the budget.

My way is to register the expenses each day according to credit card receipt.

By the way, I have added extra pages in the excel file you sent in order to detail the each categories.

Kind Regards,

Hi,

Thanks for explaining. I have a clearer picture of what you are trying to do. If you are paying off your credit card each month, then you do not need to put the credit card expense in the savings/debt category. Basically, your credit card is just the method you use to pay the expenses that you have in the needs and wants categories. Just keep in mind that this only works if you pay the card off each month, meaning you are not accumulating debt. Hopefully, you are benefiting from credit card rewards since you use it for everyday spending.

Also, I love that you have added extra pages to the excel file. That is the beauty in this method. It allows you to configure it and make it personal to you.

Hi,

Thanks for quick return. Yes, I use credit card for only a payment method in order to follow my expenses electronicaly since I have been hurt from the debts of the credit cards previously.

I have established zero dept at the moment and 50/30/20 Budget is fits perfecly. So, I have 20% of income every month goes to Savings Account Contributions.

Unfortunately, there is no credit card rewards here. The Debit card is configured to be paid at the end of each months.

Best regards,

You’re welcome! Sounds like you have a good process working.

Shawn 🙂

Please more on business advice.

I’d love to! What type of business advice would you like to see? Business ideas? Business finance? Getting started?

Shawn 🙂

Hi! I am new to budgeting and after some research, the 50/30/20 budget seems to be the most flexible and easy to follow. I am frustrated however, because I cannot seem to find an easy to use app that allows me to budget just the 3 categories. I was hoping for something like the top picture–3 pie graphs and a line graph of spending overtime. Is that a specific app? I have tried Mint and the others mentioned in this article and they seem overly complicated and time consuming. I appreciate your help with this!