Being broke sucks! Not having the money you need to purchase the things that you need or want can be frustrating and overwhelming.

The good news is, you can make changes that can get you out of this bad financial situation.

If you are broke and living paycheck to paycheck or direct deposit to direct deposit there are things you should definitely be doing to change your financial situation.

In this blog post, discover 6 things you should be doing if you’re broke.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

(1) Changing the Way You Think

This might sound odd but one of the first things you should be doing if you’re broke is changing the way you think.

Chances are you have been struggling with your finances for quite some time. Your problem could stem from how you think about money and your finances.

The way you think about money shapes your emotions and your actions. Changing the way you think will help you break bad money habits and help you make good money decisions.

(2) Evaluating Your Situation

Taking a good honest look at your situation is essential to changing your financial situation. There are multiple reasons you can be broke during periods of your life.

Are you spending too much money?

Are you unemployed?

Do you have issues with saving money?

All of these can contribute to being broke. Take the time to evaluate your financial situation.

Look at your situation objectively and without emotion and determine the areas of your finances that require a change.

(3) Reducing Expenses

Reducing your expenses will go a long way towards not being broke.

Tracking your spending and making a budget is one of the first steps to reducing your expenses. It’s hard to spend less if you don’t know where your money is going.

Once you have established your budget you can investigate ways to reduce your expenses and stretch your budget.

Believe it or not, there are ways to save money on groceries, save on items for your kids, and just about all of the necessities of life.

With a little planning, you will be managing your personal finances like a pro.

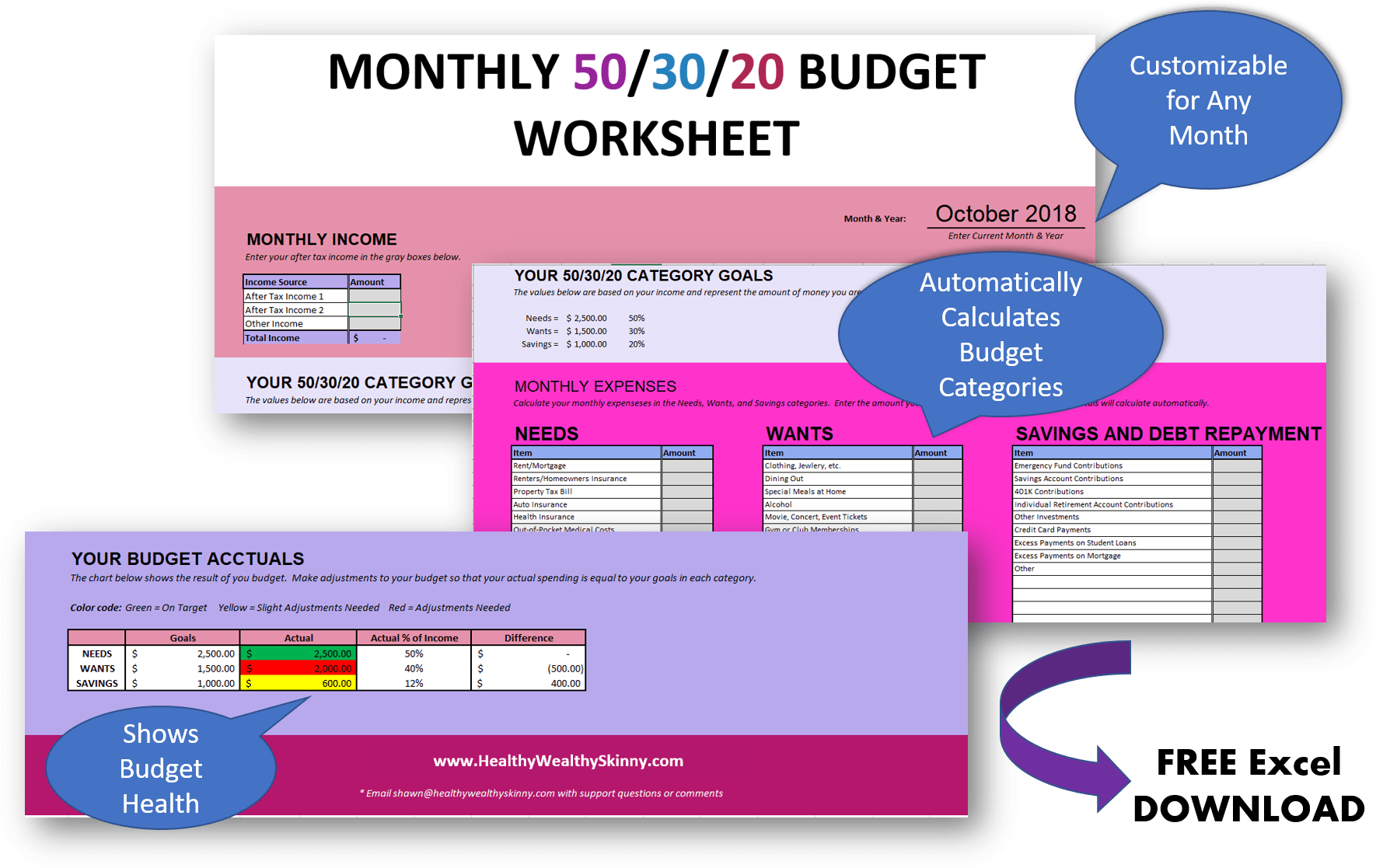

Download a copy of our free Monthly 50/30/20 Budget Worksheet. It’s a free excel spreadsheet to help you create and maintain your budget.

(4) Saving Money

Now you might be thinking, “how can I save money if I’m broke?”

Saving money when you’re broke is just a matter of making saving a priority. It is not easy, however, it is an essential element to your personal finance strategy.

Putting aside even a small amount each paycheck will make a very big difference.

Saving money and creating an emergency fund is one of the first steps you should take when putting together your financial plans. Your emergency fund will ensure that you have funds available when unexpected expenses arise. It will also protect you from going into debt.

(5) Making Extra Money

If you are broke you should definitely be looking for ways to make extra money.

Depending on your situation this might be by finding a job, working for a promotion on your current job or starting a side hustle that will help you add additional income.

There are multiple ways to make extra money online. Some yield immediate returns like taking online surveys, testing websites, or teaching English online.

There are other methods that require more time and effort, however, they yield much bigger results. Here are a few ways to make extra money without getting a traditional job.

- Starting a Blog

- Selling on Etsy

- Becoming a Virtual Assistant

- Starting a YouTube Channel

- Creating a Drop Shipping Business

(6) Spending Wisely

Learning to spend wisely will ensure that you make the most of your income. It will help you make the most of your budget and help with saving money.

Comparison shopping, using cashback apps, and shopping online

Here are a few articles that will teach you how to spend wisely when you’re broke.

Taking Action

The hardest step is always the first step.

If you are broke it is imperative that just get started. It might seem impossible at first but you can change your financial situation.

Living broke will be a thing of the past if you simply take action.

Leave a comment and share your best practices for staying financially healthy.

Don’t forget to Like, Share, Tweet, and Pin this post.

Living in Los Angeles, I constantly feel broke and I feel like I am always scrambling for money. I’ll definitely have to take a few of these tips to heart — especially the spending wisely. I do spend quite a bit on clothes!

Thanks for sharing! x

Michelle

dressingwithstyle-s.com

Hi Michelle! I’ve heard that living in LA was pretty expensive. For me I have to watch my spending on shoes.

These are some great ideas! I like to earn extra money any way I can. Mostly, I use grocery rebates and coupons among other things. Also, I am always on the lookout for a side job that pays decent! Being a stay at home mom means I really have to get creative with the ways I earn money, but it is certainly not impossible.

Thanks Joanna! When looking for ways to make extra money at home check out online tutoring, teaching English, testing websites, and proofreading. You can make some good side cash with these options.

How would someone get into proofreading?

Hey Desirae,

There is a link that will get you started proofreading in the post below:

https://www.healthywealthyskinny.com/ways-to-make-extra-money-when-youre-broke/

Although everyone thinks living in Texas is “cheaper”. It’s not! Especially when you don’t have good money managing skill. I’m 27 and I like enjoying nice thing but it constantly leaves me broke. Most definitely going to apply these thing to my life style hopefully things can change for the best!

Hi Camyron,

Things will get better. You can enjoy nice things and have money left over to enjoy and save. It just takes a little money management. Make sure you sign up for my email list on the home page. I’ve got a new system coming out in the next week or two that you should use.

Shawn 🙂

It’s been a long time since I felt broke, and I don’t miss those days at all. It was such a struggle when I was a single parent just trying to make it from pay cheque to pay cheque – this are great tips for anyone who is in that situation! I’ve been really trying to impress on my son not to take on debt – living within your means is the single most important thing you can do to reduce financial stress – and it’s so much easier to do if you aren’t trying to pay of debt. Great article 🙂

So true Nicole. I love that you are teaching your son so he doesn’t have to experience feeling broke.

I went to a counselor to help but I don’t make enough money. I had to pay off loans and things so had to make a list of the bills and slowly pay them off. I put in my 401K 5% and try to put 25%in my savings. But at this year I have no savings and I use every check for bills. I have paid off alot of the bills and by making a budget I see where I can begin saving again. This year was looking rough but I am making progress.

Keep at it Amy! You might want to look into ways to make a little extra money on the side. Just to have something to save. There are a few articles on the site to help.

Great tips! I need to do better at being more frugal … one way we spend too much money is we like to eat out, but I have found buying my groceries and preparing meals definitely saves us money. Also, putting away some money the beginning of the month helps (emergency savings). Thanks for sharing your ideas and the links, very helpful!

You’re welcome Kristina. Eating out is my thing too. I’ve cut down but I still give my self a few treats.

I have begun spending a few dollars a month at Dollar Tree, for staple grocery items that I regularly use: dried beans, pasta and noodles, my preferred canned spaghetti sauce, family-sized tea bags (two boxes of 24 for $2, compared to $2 for one box of 24 at the other dollar store that I use), etc. I have also spent a small bit over the last 18 months, buying kitchen utensils and such. And I’m currently always looking for more stuff that I actually need, that Dollar Tree offers. Of course, I can’t do all of my grocery shopping there, but I’m determined to get all that I can that makes sense for me. By doing this and other frugal, miserly methods, I put a little bit over $500 on debts this month, out of my $1,018/month retirement check. I may not be able to put that much every month as things come up, but I will do it as often as possible if all goes as planned I hope to pay off one debt by the end of 2020, leaving me only one to knock out after that. It’s great motivation to begin to see the light at the end of the tunnel and believe that maybe it’s not the train!

1st step is always hardest. Saving money is one of the hardest things to do at least for me but its important. I never save money in a form of cash. I always buy the prize bond. In this way, I can not only save money but I also get more money when any of my prize bond number selected in the draw.

Great Tip Sarah! Saving is hard. I like the idea of getting more from your savings.

Thoughtful post. With these steps, being broke is hard

Being broke is truly hard. I’ve been there. But the good news is that it can be temporary.

I’ve been working on my money mindset this year and I completely agree number 1 is so important. Changing the way you think is huge in this process ?

Hey Lucy! Changing the way you think works wonders. Many times we don’t recognize how we block ourselves from our goals.

Excellent steps to take. You are right about changing the way you think. I know many people who talk about being broke but actually lead very extravagant lives. They just want more than they already have.

Thanks Charlotte! Mindset is super important. And yes there are those who like to say their broke but they just have very poor spending habits. This is where self-evaluation comes into play. You have to give an honest look at yourself and how you handle your money.

I went to make money through youtube, how do I go about it?

Interest free credit card. Credit card interest and late charges will eat you alive. Buy whole grain hot cereal in bulk. Share bulk purchases with

a friend. Brown rice paired with beans make a complete protein, thus making a substitute for meat twice a week. Learn how to make your own yogurt. Trade baby sitting chores. Cook extra on the Sabbath and freeze some of it. Eat at home except on your birthday. Read on the internet; magazines. books, newspapers, recipes, movies. Stay away from delivered pizza. Stay away from coin laundries. Dry your clothes on a clothesline.

Thanks Richard! These are some great suggestions.

Interestingly, I am very mindful of savings and always getting a bang for my dollars. What will benefit me is breaking down my budget on the Excel spreadsheet. I can already tell that I need additional income because my needed expenses such as; rent utilites, car payment, expenses take a huge portion of my income. I will map this out and move up. Thank you for this article.

You’re welcome Tru. And I know the feeling. That Needs category can be a real monster. This blog is the result of me realizing that I needed to bring in extra income. Good luck on your journey!

Living Poor With Style came out in the seventies, (I think, maybe early eighties). It had some great ideas. Wonder if it can still be found.

Very good point. You can live poor with style and it’s nothing new.

I really enjoy your article. I’m on Social Security and small pension. I’m not good with budgeting. My husband did all that and he’s passed. I’m so discouraged and getting a part time job in your 80’s is hardly possible. I’m looking for some place to go to get advice. Thanks

Get a $1,000 buffer then pay off debt. After debt, save for 6-9 month expenses. One way to start up the process, especially when broke.

Johnny, this is excellent advice. That $1000 emergency fund is a lifesaver. It’s also really cool when you can then kick that emergency fund up to 12 months of expenses for some serious security.

I have used several tricks to curb spending and to save more. All change from the day (mine & hubbies) goes into a small jar. When jar is full, I roll it and put in savings account. If I see something I want, I make myself go back the next day to buy it. Vast majority of time I’ve forgotten about it or rethought the “need.” I like Starbucks, but make it a treat instead of a daily thing. I get it on a day when I know work is going to be tough or when a death anniversary occurs. Something I know will try to pull me down. ONLY once a week. I work hard to reuse or repurpose what I already have up instead of buying new.

Hey Mary, these are some great tips. I love the idea of making Starbucks a treat. Thanks so much for sharing.

I’m in the middle of a divorce and I have credit card debt and loan debt with my husband. We also have a car loan that I am paying for. I made the mistake when I added my Neice and her husband on my credit cards to help build up their credit. My score was at 740 and now it’s in the low 500, which makes me really sad. My husband is PO with me cause I was trying to help my Neice. He helped me out and took on some of my old credit card debts. He is furious when he found out I was helping family. Now we are in the middle of this divorce. But we have problems on top of the debt. Just trying to find my way out of a abusive relationship and figure out how to remove my Neice off my accounts. I alone owed 6k but now that she has been on my cards I’m owing 20k. Overwhelmed in Hawaii called Paradise.

I find that evaluating my situation is an evolutionary thing in life. I try to plan monthly what my expenses will be, and how much I plan to make that month. My income often stays the same, but I will have an occasional expense, like car maintenance, carpet cleaning, or even just planning to eat out a little more. By staying on top of it, I have found that I can enjoy these unusual payments, and remove the stress of money. I couldn’t agree more with your tips. Very helpful.